tax break refund unemployment

Generally after using all of your available exemptions the remaining unprotected amount is often little or nothing. Dec 30 2021 What are the unemployment tax refunds.

Unemployment Compensation Are Unemployment Benefits Taxable Marca

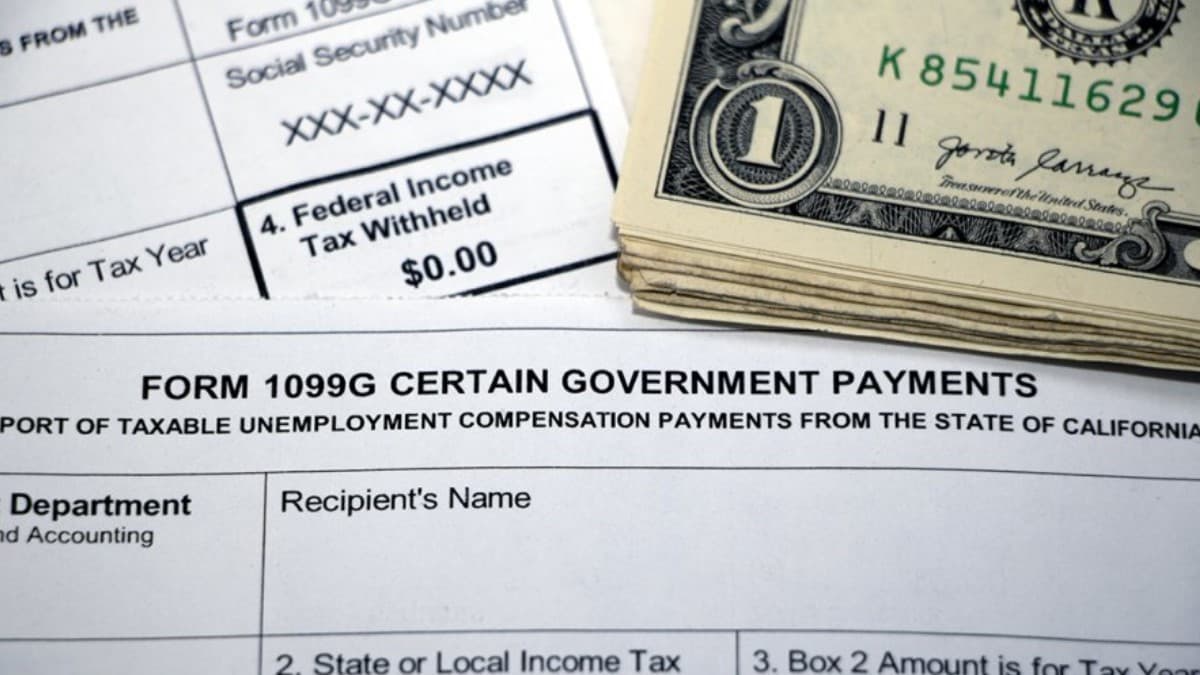

Taxpayers eligible for the up to 10200 exclusion who have already filed 2020 taxes claiming their unemployment insurance benefits.

. Ad Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. Still Waiting On Your 10200 Unemployment Tax Break Refund.

The 10200 is the amount of income exclusion for single filers not the amount of the refund. Specifically the rule allows you to exclude the first 10200 of benefits up to 10200 for each spouse if filing jointly from your income on your federal return if you have an adjusted gross income of less than 150000 for all. Unfortunately an expected income tax refund is property of the bankruptcy estate.

The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. If you received unemployment benefits in 2020 a tax refund may be on its way to you. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

The unemployment tax refund is only for those filing individually. File unemployment tax return. Total the New York State tax withheld amounts from all IT-1099-UI forms.

Direct Deposit into a bank account of your choice or via a Bank of America debit card If you choose the debit card method you may use them at any. Find recommended local service professionals get free quotes fast with Bark. Unemployment Income Rules For Tax Year 2021.

This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return. However the American Rescue Plan Act changes that and gives taxpayers a much-needed unemployment tax break. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT You can receive your unemployment benefits two ways.

File Form IT-1099-UI as an entire page. Report unemployment income to the IRS. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

The 150000 income limit is the same whether you are filing single. Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income. When it went into effect on March 11 2021 the American Rescue Plan Act gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

Recipients may not get a tax break this year which means they should take. Well break down the tax agencys timeline for that money and how to use your tax transcript for clues. The amount of the refund will vary per person depending on overall income tax bracket and how.

Include this total on the Total New York State tax withheld line on your New York State income tax return. This means that you dont have to pay federal tax on the first 10200 of your unemployment benefits if your adjusted gross income is less than 150000 in 2020. 15 million more refunds from the IRS are coming with the latest batch of payments.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Definitions for the Senior Freeze Property Tax Reimbursement Program. Married filing jointly.

Check cash and cleared but return wasnt actually processed until May 24 2022 - YES 2022. How to calculate your unemployment benefits tax refund. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

A quick update on IRS unemployment tax refunds today. Stay up to date on vaccine information. Show Alerts COVID-19 is still active.

You Might Be Able To Turn That Tax Bill Into A Refund. Unemployment Federal Tax Break. Call NJPIES Call Center for medical information related to.

Many filers are able to protect all or a portion of their income tax refunds by applying their bankruptcy exemptions to the expected refund. Do not attach your federal. My wife had over 9000 in unemployment due to Covid and the dental office being closed and when i re-ran my HR Block software it said we over paid by over 2000.

Attach this form IT-1099-UI to your New York State income tax return Form IT-201 or IT-203. And i never submitted an amended return because the IRS says not to. You had to qualify for the exclusion with a modified adjusted gross income of less than 150000.

The American Rescue Plan Act which was signed on March 11. The refunds will happen in two waves.

Unemployment Benefits Tax Free Do You Need To Amend Your 2020 Tax Return Youtube

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Bookkeeping Business Business Tax Small Business Bookkeeping

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

Stimulus And Taxes How To Shield Up To 10 200 In Unemployment Benefits From Income Taxes Syracuse Com

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Still Need To Do Your Taxes Here S A List Of Items Most Taxpayers Need To File Their Tax Return Taxes Taxpreparation Tax Refund Tax Preparation Tax Return

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Stimulus Check Status Update Irs Payment Timeline What To Know About Plus Up Money Irs Send Money Tax Refund

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Average Income Tax Preparation Fees Increased In 2015

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor